colorado employer payroll tax calculator

DR 0004 Employer Resources. Account Set-Up Changes.

8 Things To Know About Oregon S Tax System Oregon Center For Public Policy

As the employer you would be responsible for deducting the following taxes.

. Use ADPs Colorado Paycheck Calculator to calculate net take home pay for either hourly or salary employment. Global salary benchmark and benefit data. Get Started With ADP Payroll.

The Colorado Withholding Worksheet for Employers DR 1098 prescribes the method for calculating the required amount of withholding. DR 0145 - Colorado Tax Information Authorization or Power of Attorney. Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Colorado.

Ad Process Payroll Faster Easier With ADP Payroll. Discover ADP Payroll Benefits Insurance Time Talent HR More. Make Your Payroll Effortless and Focus on What really Matters.

Colorado payroll calculators Latest insights The Centennial State has a flat income tax system where the income taxes are relatively low compared to the rest of the country. It simply refers to the Medicare and Social Security taxes employees and employers have to pay. Number of Qualifying Children under Age 17.

Enter your info to see your. 124 to cover Social Security and 29 to cover Medicare. This 153 federal tax is made up of two parts.

Just enter in the required info below such as wage and W-4 information. DR 1102 - Address or. Supports hourly salary income and multiple pay frequencies.

Colorado Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Withhold 62 of each employees taxable wages until they earn gross pay. Simply enter the calendar year your premium.

Social Security has a wage base limit which for 2022 is. Colorado Paycheck Calculator - SmartAsset SmartAssets Colorado paycheck calculator shows your hourly and salary income after federal state and local taxes. Calculating your Colorado state income tax is similar to the steps we listed on our Federal paycheck calculator.

Colorado allows employers to credit up to 302 in earned tips against an employees wages per hour which can result in a cash wage as low as 808 per hour. Choose Marital Status Single or Dual Income Married Married one income Head of Household. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Colorado.

Wages 1a Enter the employees total taxable wages this payroll period1a 1b Enter the number of pay periods you have per year see. Discover ADP Payroll Benefits Insurance Time Talent HR More. The standard FUTA tax rate is 6 so your max.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Prepare your FICA taxes Medicare and Social Security monthly or semi. Make sure you are locally compliant with Papaya Global help.

Check if you have multiple jobs. Well do the math for youall you need to do is enter. DR 0137 - Claim for Refund - Withholding.

Ad Payroll Employment Law for 160 Countries. All Services Backed by Tax Guarantee. Ad Compare Prices Find the Best Rates for Payroll Services.

Colorado Paycheck Calculator Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Employers are required to file returns and remit.

The Colorado Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Colorado State. Figure out your filing status work out your adjusted gross income Total. Ad Process Payroll Faster Easier With ADP Payroll.

No Withholding Tax Collected. How to File Your Payroll Taxes. Social SecurityOASDI 6200 Medicare 1450 Fed WH 9700 State WH 3600 Net.

DR 0096 - Request for Tax Status Letter. Get Started With ADP Payroll. The Premiums Calculator may save you time and hassle and help ensure you pay the correct amount of unemployment insurance premiums.

Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator.

/GettyImages-1253210097-57c74c5f5a404728a93b31348bf54cf6.jpg)

Severance Package Explained The Layoff Payoff

Sui Definition And How To Keep Your Sui Rate Low Bench Accounting

Marginal Tax Rate Formula Definition Investinganswers

Self Employment Tax Calculator For 2020 Good Money Sense Business Tax Deductions Business Tax Money Management Printables

Analyzing Financial Data Business Loans Accounting Services Accounting

What Are Guaranteed Payments Bench Accounting

How To Fill Out A W 4 Form Without Errors That Would Cost You Employee Tax Forms Tax Forms Job Application Form

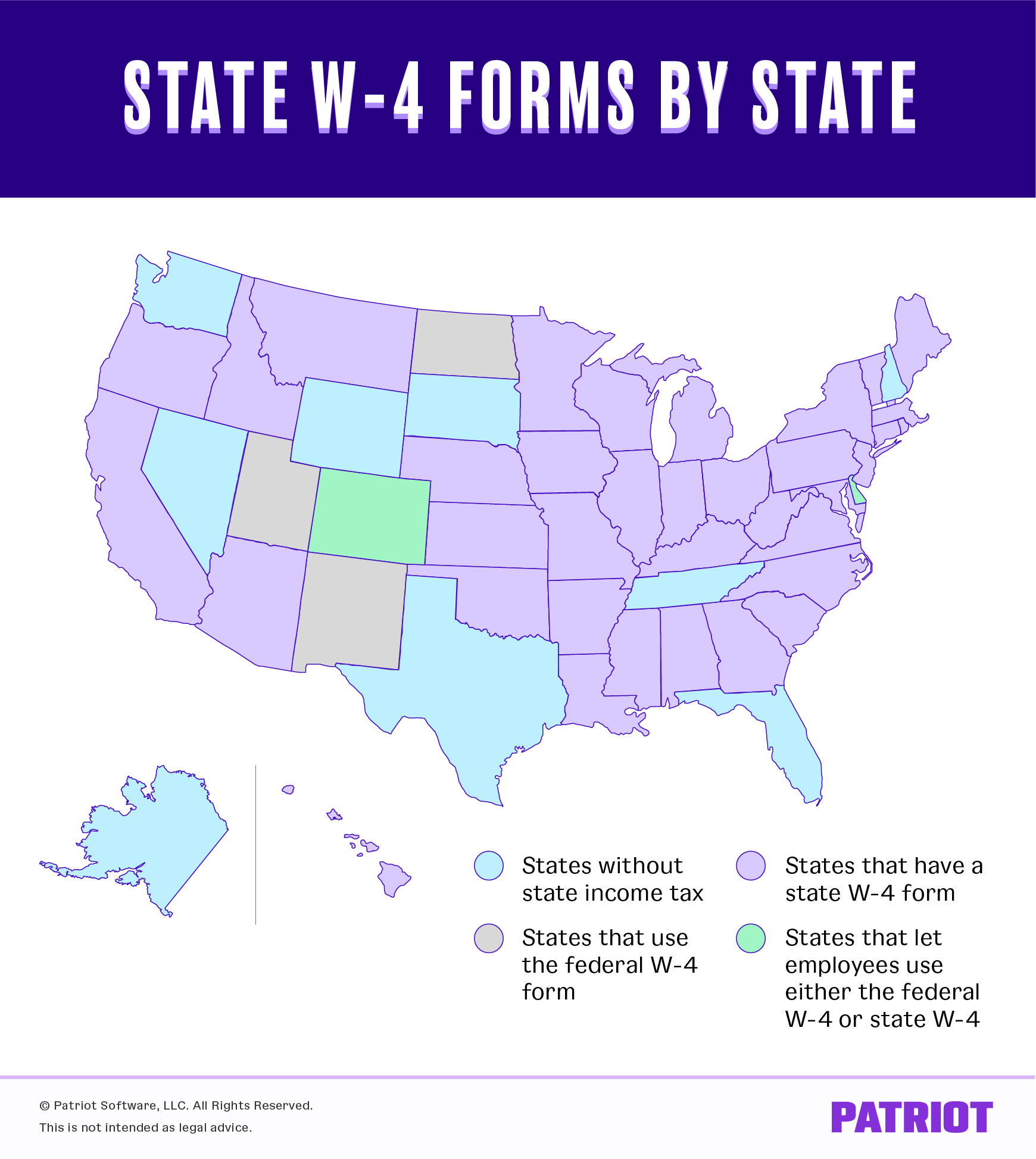

State W 4 Form Detailed Withholding Forms By State Chart

Au Pair Taxes Explained J 1 Tax Return Filing Guide 2022

Self Employment Tax Calculator For 2020 Good Money Sense Business Tax Deductions Business Tax Money Management Printables

What S The Most I Would Have To Repay The Irs Kff

Is It Time To Downsize Your Business

State W 4 Form Detailed Withholding Forms By State Chart

Us Taxes For Digital Nomads 8 Tips You Should Know

Self Employment Tax Calculator For 2020 Good Money Sense Business Tax Deductions Business Tax Money Management Printables

10 Best Tax Software Of 2022 Money